[Updated April 19, 2023]

The previous financial year brought in 4.4 million people claiming a work from home deduction, a 1.1 million increase compared to 2019. Many people will agree that there are some advantages to working from home.

There’s no need to buy office clothing and lunches. Transport costs are also not an issue. But it also means that electricity bills will be higher and you will need the Internet for work. Home office equipment and furniture should also be ready for use. If you work from home, there’s good news. You may be able to claim deductions for your expenses – but that is if you know what you can claim on your tax return.

How Do You Know What You Can and Cannot Claim?

The ATO’s guideline is pretty simple. You can claim deductions for expenses for:

- Working from home to perform your employment duties and not just taking client calls, checking emails, and other minimal tasks

- Additional costs when working from home

Now, what if you have a home-based business? If you operate your business directly from your home, there are also deductions that you can claim. You also qualify for the same deductions even if you do not run your business from your home. For example, you go to a client’s house to perform your duties as a tiler. The same rules apply when you work from home in a home office setting as long as you do all the recordkeeping in your home and you store your equipment or tools relating to your business on your property.

Home Office Expenses

If you have a home office, you can qualify for a deduction for the following expenses:

- Occupancy expenses, including rent, mortgage interest, house insurance premiums (with strict limitations and not everyone will qualify), and land taxes

- Electricity bills, including heating, cooling, and lighting

- Home office equipment, such as printers, computers, telephones, and laptops

- Phone calls and phone rental

- Home office furniture depreciation, such as cupboards and desks

- Office equipment depreciation, including computers, tablets, and mobile phones

- Other items that you use for work, such as computer consumables, stationery, corporate calendars, cleaning costs, and furniture repair

If you do not have your own separate space for working from home, it’s crucial to calculate only those expenses explicitly relating to your job. For example, the rest of your household also uses lights, heaters, and air conditioners. Therefore, you can only claim a portion of the utility bills when you actually use the appliances and lighting for work.

If you just purchased home office equipment, such as a computer, you are entitled to claim a deduction for that purchase. All depreciating assets are claimable for their full cost if you spent $300 or lower. If the item is worth more than $300, you can only claim the decline in value. Meanwhile, if you are self-employed, you may be entitled to write off any equipment purchase up to $20,000.

How Much Can You Claim?

The total deduction that you can claim depends on what you can claim and how you work. Let’s say that your home is the primary place of work, and you have your own space for working. In this case, you can claim occupancy and running expenses, as well as business phone costs and office equipment decline in value. On the other hand, if you work at home but do not have a separate area for your employment duties, you cannot claim occupancy expenses and depreciation of carpets and light fittings. You can, however, claim a decline in the value of office equipment, including computers, desks, and chairs.

There is no maximum in the amount of deduction you can claim. The amount you want to claim must be calculated based on the guidelines set by the ATO.

There are two ways to calculate the deduction. Note that you should still show a diary or receipts to substantiate your claim. ATO introduced the shortcut method, which was only usable from 1 March 2020 to 30 June 2021. Its goal was to make it easier for people working from home to calculate their expenses. This method is similar to the fixed rate method, which is explained below. The main difference is that you could claim 80 cents per hour for every hour you work from home.

Now, let’s discuss the allowed methods for calculating deductions for work from home expenses 2021. As mentioned, you have two options:

- Fixed-Rate MethodThis method is for those who work from home with a dedicated space as a home office and have records to prove their work hours and work-related expenses. The fixed-rate is 52 cents an hour for electricity and gas expenses, cleaning costs, and a decline in value of home office furnishings and fittings. Other expenses that you can claim using the fixed-rate method are:

- Phone and mobile data expenses

- Computer or phone accessories

- Internet expenses

- Computer consumables

- Stationery

- Depreciating assets like computers and laptops

The ATO has provided a home office expense calculator if you have trouble determining your deduction. However, note that the result you get should be used as a guide and not an accurate figure of your total work from home deduction.

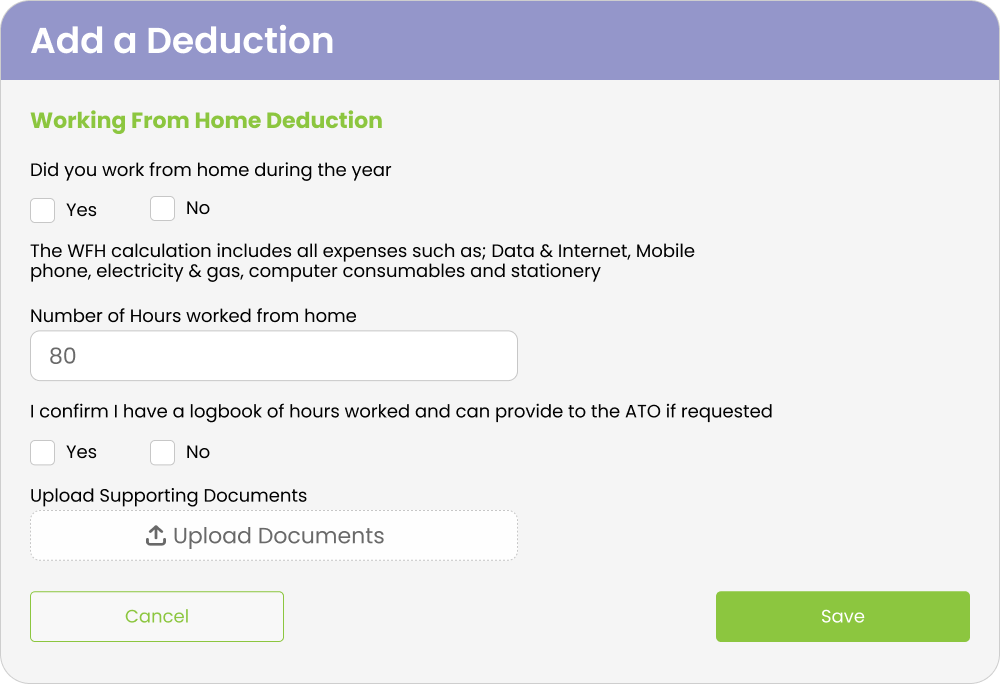

- Actual Cost MethodAnother option is using the actual cost method, which is applicable for those working from home with detailed records of their expenses. Running expenses do not count if other people in the household are in the same room while you work from home.As the name suggests, this method requires you to calculate the actual cost of your cleaning, heating, cooling, lighting, and other expenses. To get the maximum deduction, you should have a dedicated work area; otherwise, you will only incur minimal additional expenses.This calculation method is more complex since you have to be thorough in computing the costs. For example, when working out the cost of utility and gas, you should get the cost per unit of power used. You will need to rely on your utility bill to get this piece of information. You should also know the average units used every hour or the power consumption per kilowatt-hour for every appliance or light. Finally, you have to get the total annual hours for work-related use. You can get this information from your diary.It’s essential to keep all receipts and other pertinent documents, so you can use them as proof for your calculation. We recommend signing up with TaxReturn.com.au if you haven’t done so to keep track of our expenses and receipts. You can simply upload them and check the information as you fill out your tax return information.

Keeping a Diary

To make claims much easier, you should have receipts and a diary that will help back up your claim. Diaries are useful in recording small expenses, such as those that are $10 or less, up to $200 in total. Some expenses do not have receipts or evidence of any kind. You can write them down as an entry in your diary, which you will show the ATO.

Diaries are also used for your running expenses, such as heating and lighting. It should provide all the details, including the time you spent in the home office compared to other members of the household or parts of the house. A diary record should at least contain four weeks of a representative period, which will include calculations based on your use of home office equipment.

The Temporary Shortcut Method

Whether you use the Fixed Rate or Actual Cost Methods to file, the ATO has a programme in place to help you calculate your working from home deductions called the Temporary Shortcut Method. It has several stipulations, but this method can save you a great deal of time working out your tax deductions for working from home. To be eligible you:

- Worked from home and incurred some additional running expenses as a result

- Have a record of the number of hours you worked from home

- Are filing for the 2021–22 income years

How the Temporary Shortcut Method Works

The purpose of the Shortcut Method is to help taxpayers who work from home by simplifying how deductions for working from home expenses are calculated. When you use this method for calculating at-home expense deductions you,

- Can claim 80 cents per hour for each hour you work from home

- Cannot claim any other expenses for working from home, even purchasing new equipment

The Temporary Shortcut Method covers your at-home work expenses such as,

- Phone and data expenses

- Internet expenses

- The decline in the value of equipment and furniture

- Electricity and gas for heating, cooling, and lighting

Because the decline in value of your furniture and equipment is a part of the Shortcut Method, you do not need to calculate the decrease in value of depreciating assets as part of your work-from-home expenses.

After calculating your expenses incurred working at home, enter the amount in the other work-related expenses section in your tax return. Also, add the description COVID-19 hourly rate.

Know the Expenses You Cannot Claim

Understanding the working-from-home expenses, you are not allowed to claim is as important as knowing what you can claim. The ATO issued a warning to Aussies working from home. Lists of tax deductions will be carefully examined because so many people are claiming various deductions that they are not eligible for because they are working from home.

Five Things You Cannot Claim as Working from Home Deductions

- Occupancy Expenses – Many taxpayers wrongly believe that because you work from home, you should be able to get deductions for mortgage repayments, rent, or interest. There are limited circumstances where these can be deducted, but few people qualify.

- Time Spent Not Working – When calculating the hours you work each day, do not include your lunch break and any time you spend doing something other than work.

- The Decline in Value of Items Provided by your Employer – Many companies provide the tech equipment necessary to keep their employees working when working from home is a necessity. However, you cannot deduct depreciation of equipment you did not pay to own.

- The Niceties – Your employer may have supplied coffee, tea, sugar, cream, and biscuits at the office. However, you cannot deduct the cost of similar grocery items purchased for use in your home office.

- Items You Buy, but Your Employer Pays Reimbursement – If you are reimbursed for something you bought, you technically did not buy it.

What Are the New Tax Rules for Claiming Work from Home Expenses For 2022-2023 Financial Year?

In ATO’s revised record keeping requirements for calculating work from home deductions, the revised fixed rate method has been updated to reflect working from home arrangements. As a result, the fixed rate has changed from 52 cents to 67 cents per hour. The revision also removed the requirement to have a dedicated home office space. It further allows you to claim separately the work-related portion of decline in value of depreciating assets.

Taxes can be a challenge, even if you have lodged them many times in the past. If you are unsure what you need to do, feel free to reach out to us at Tax Return. Our tax portal and tax experts can help you file your taxes the right way easily in minutes.