It’s almost time to lodge your tax return, which means it is time to start thinking about work-related expenses you may have paid over the financial year. Because they’re work-related, they pertain to expenses that directly affect how you earn your income. The law allows you, as an Australian taxpayer, to claim certain expenses as deductions to lower your taxable income.

Here are some questions to ask to identify if the expense is acceptable as a tax deduction:

- Did the expense influence how you perform your job or generate your income?

- Did you pay for the expense but your employer did not reimburse you?

- Do you have a receipt, bank statement, or any official record that proves the expense?

Get Your Work-Related

Claimable Expenses Guides

What can you claim as a tax deduction? What can you not claim? It is not always easy to itemise the list of expenses that the ATO will accept as tax deductions. There are two primary requirements to bear in mind. First, the costs should be work-related.

Second, they should have a direct effect on how you earn your income. If you have records that show any of these purchases, lodging your income tax return will certainly be a breeze.

To make it even easier for you, we have designed a collection of tax checklists that you can use as you prepare your tax information. Pick your relevant expenses checklist above and check it twice to make sure you don’t any claims applicable to your situation.

Car Expenses

If you drive your own vehicle in performing any work-related tasks, you may be entitled to claim a deduction for all the expenses incurred. The vehicle you use can also be hired or leased. Cars or vehicles described here pertain to any motor vehicle (except motorcycles and other two-wheelers). These cars should be able to carry less than nine passengers and one tonne. Almost all four-wheel vehicles are considered a part of this definition.

As with any other claimable expense, the car expense should be wholly for work-related purposes. If it was partly private, you can still claim a portion of the total cost. You can claim car expenses for the following situations:

- Your employer asked you to carry a heavy or bulky tool to store in your house or another place because there is no secure storage available at work

- You go to job-related conferences, which are not in the same area as your workplace

- You need to deliver or collect items

- You have two or more jobs and you need to drive to the other locations

- You travel to another location of your current company

- You have to visit a client or another alternative workplace

If your employer gives you an allowance for car costs, include the amount in your tax return as assessable income. All trips from home to work or vice versa are excluded and viewed as private travel, even if you use your own car for these trips.

Clothing & Laundry

If you purchased occupation-specific clothing any uniform directly related to your job, you may be able to claim this particular cost. You are also entitled to claiming other expenses, such as laundry, dry-cleaning, and repair of those uniforms.

However, you cannot claim costs for work uniforms that are deemed conventional or non-compulsory clothing. An exception is protective clothing, depending on your job. For example, if you work outdoors, you can claim the purchase of footwear and sun-protective clothing.

You can make claiming these costs much easier by preparing written evidence prior to lodging your tax return. Some documents approved as evidence include diary entries and receipts.

Working from Home

If you have home office expenses, you can claim many of the costs you may have incurred over the current financial year. Some of the costs that you can claim as tax deductions include the following:

- Phone expenses

- Internet expenses

- Printer paper, ink, stationery, and other computer consumables

- Computers, furnishings, furniture, printers, phones, and other home office equipment

Claiming a deduction when you work from home is a bit complicated. You can either claim the full cost of the items or their decline in value. To get the full amount back, the purchase should be less than $300. However, if the item, such as a computer or laptop, exceeds $300, the deduction you will get will be based on its depreciating value.

Keep in mind that you may not be able to claim certain costs, such as:

- Mortgage interest, rent, and other home expenses

- Coffee, tea, milk, and other general household costs

Working from home typically means that certain items and spaces are utilised for personal purposes. For instance, your lounge room can be where you work, which means you cannot claim for the entire cost in that area. It helps to have a separate room for work to make computation much easier.

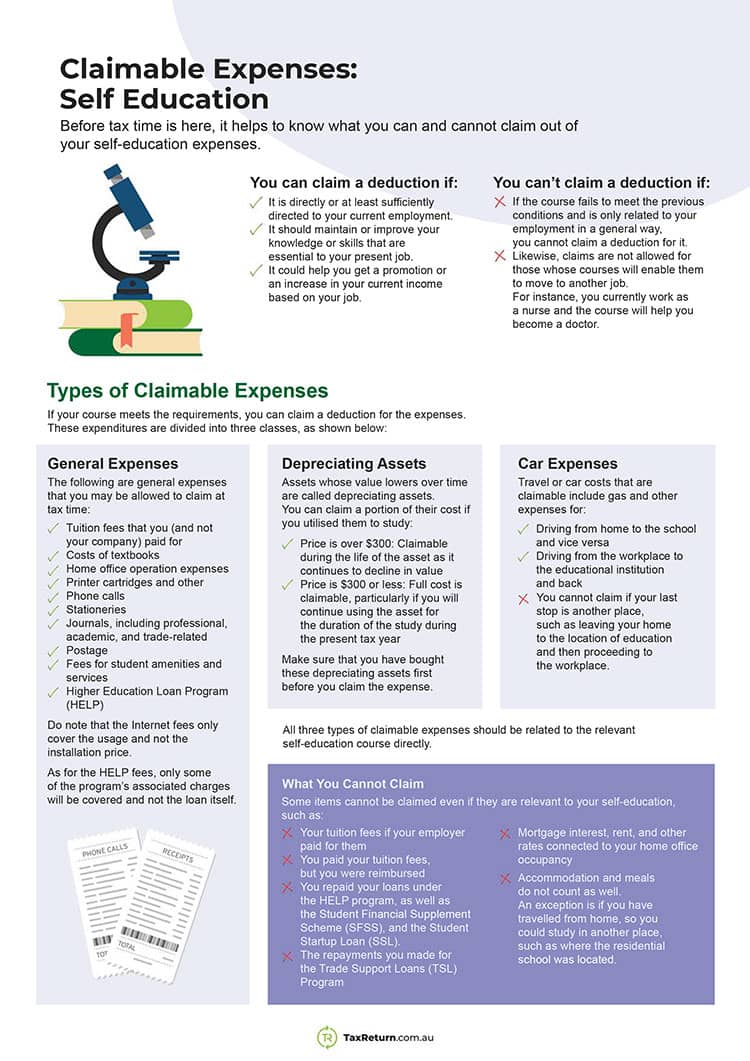

Self-Education

If you have enrolled in a class or course that will help you improve on your job, you may be able to claim for the expense. Once again, it should be related to your current employment and should not facilitate in getting a promotion or a change in your job title. The course, however, can help you gain an increase in income.

To claim the expense as a tax deduction, you should provide evidence that the course or education is connected to your job. If so, you can claim the following:

- Computer and Internet expenses (except connection cost)

- Tuition fees

- Phone calls

- Computer consumables like stationery

- Textbooks

- Student union fees, amenities fees, and student services

- Accommodation and food if the class is in another area, requiring you to stay overnight

- Equipment purchases equivalent to $300 or less

- Depreciating assets for purchases over $300

- Equipment repairs

- Running costs for home office

- Journal subscription and fees

For some expenses that were made for other purposes, you are only allowed to claim the specific costs relating to self-education.

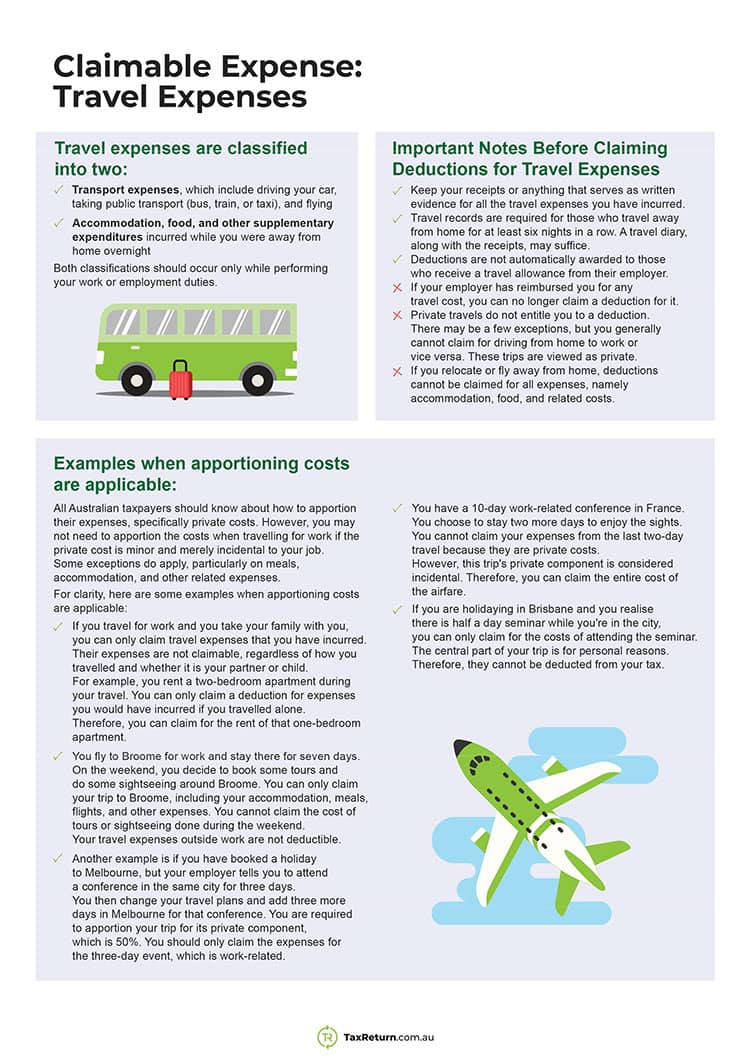

Travel Expenses

Travelling to work from home and vice versa cannot be claimed even if you do it on a daily basis. This type of travel is considered private. You also cannot claim normal trips to work even if you had to pick up the mail or do simple tasks on the way. Other unclaimable trips include working overtime with no public transport available and travelling to work for an emergency meeting or interview.

For business travels, you can claim the following:

- Airfares

- Train and bus fares, as well as ride-sourcing and taxi costs

- Fees incurred for hiring a car, along with fuel, tolls, and parking costs (Applicable only for business car hires)

- Accommodation and meals

You may also be able to claim the costs of driving your car or another person’s car. This vehicle, however, should not be defined as a car intended for work purposes. If you purchase other vehicles, you cannot claim the expense. However, you may be able to claim their decline in value.

The expenses mentioned are for overnight travels and can only be claimed if you have a permanent home in another place. Your job should require you to stay away from home for the rest of the night.

You cannot claim a holiday or a visit to loved ones even if you stay overnight. If you combine the trip with a business or work-related travel, you may be able to claim the business-related costs. Fines are not covered, even if you are in the area for work.

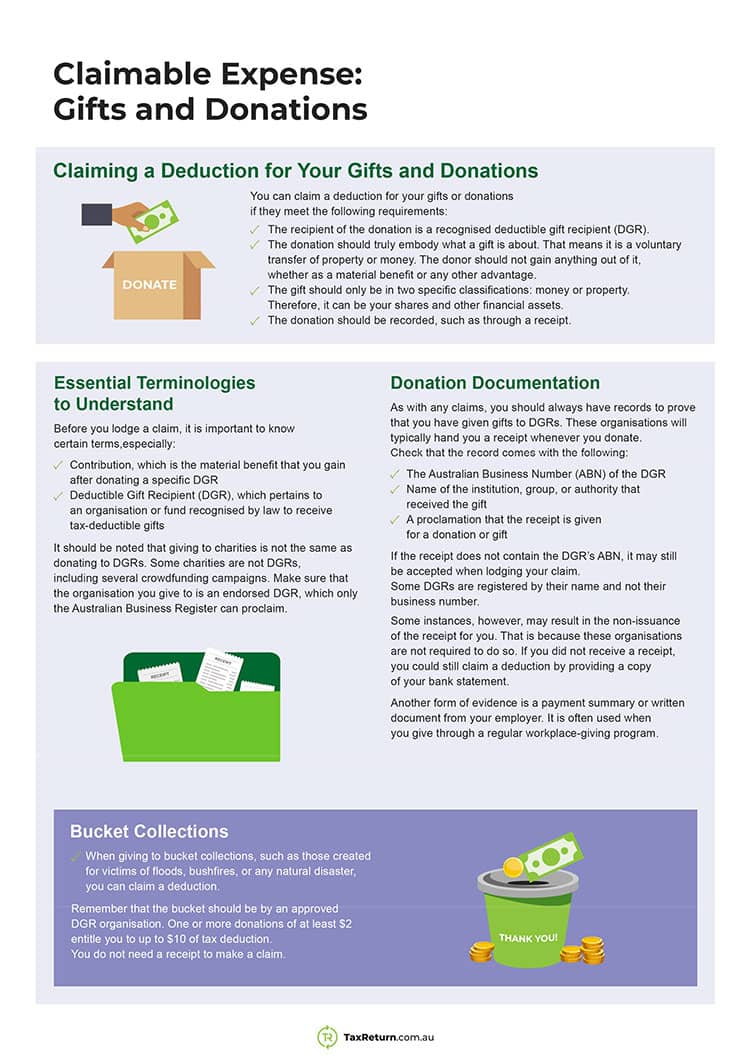

Donations and Gifts

You cannot claim gifts and donations unless you gave to an organisation with a deductible gift recipient (DGR) status. Apart from this condition, the donation should also meet the following key criteria:

- The gift should be money or property.

- You can also donate financial assets, including shares.

- You have voluntarily transferred or donated the gift without getting something in return.

Some DGRs have set their own conditions. Before you donate or give a gift, you should know about these requirements so that you can receive the tax benefit in the end.

A donation or gift is described as something you offer to an organisation or charity without receiving a material benefit. If you did receive an advantage or anything in return, it is called a contribution. You can claim for a deduction for a contribution you have made, although there are more conditions to be aware of.

Note that you cannot claim for everything that you have donated even if it is to a DGR. The amount should be at least $2 to claim gifts of money. For properties, the rules are different and will depend on the type and value of the property you have donated.

The best way for you to claim a gift, donation, or contribution as a tax deduction is to have a record of the transaction. It can be in any form, such as a receipt from the DGR or a bank statement.

Get All The Checklist To Your Inbox For Safe Keeping!

Latest News

Simple Tax Deductions Guide for Doctors and Medical Specialists

If you are a doctor or medical professional in Australia, we are grateful for you! We’ve put together this guide...

Read MoreSimple Tax Deductions Guide for Truck Drivers

If you are a truck driver, you may be eligible to claim a variety of tax deductions. Knowing the truck...

Read MoreSimple Tax Deductions Guide for Hairdressers, Beauticians and Nail Technicians

Are you missing out on tax deductions as a hairdresser or beauty professional in Australia? You may be eligible to...

Read More