Tax Return Calculator

Ready To Get Your 2024 Tax Return Estimate?

Your Estimated Tax Refund

$0.00

Reset

Let's get you more!

Get an instant tax refund in a few simple steps. Our team of expert Australian accountants will review your return to ensure you are getting the best refund possible!

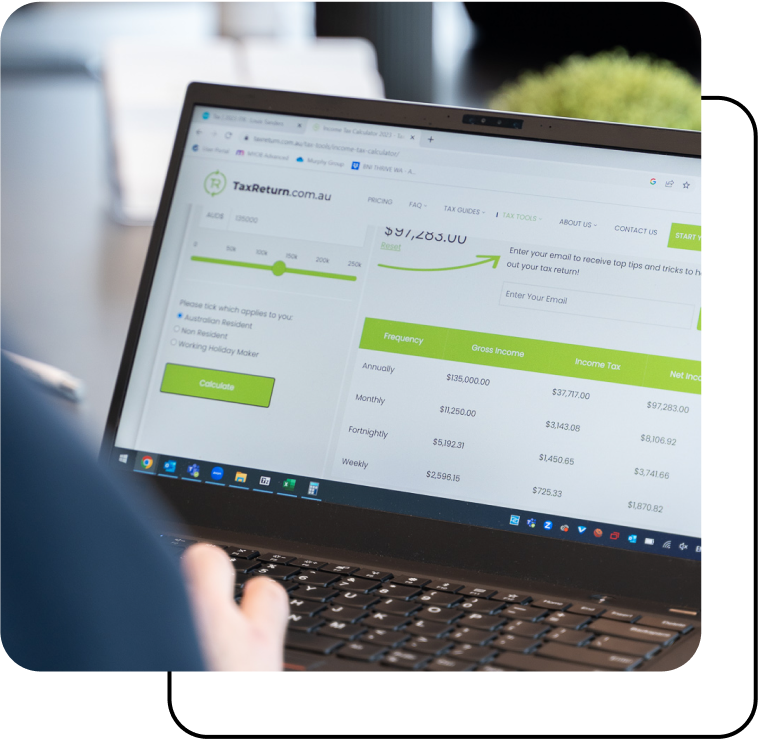

How Does the Tax Return Calculator Work?

The tax return calculator uses your income data and withholding tax information to calculate the tax payable or the tax refund due. Employers are required to provide income information for their employees. They do that by reporting to ATO each pay day or by providing a payment slip to employees. That forms the basis for total income calculations. The employer reports also indicate the tax withheld.

The tax calculator uses your total income information and tax withheld to calculate tax payable or tax refund. Once you have your taxable income, the next step is to determine the total income tax for the year. That takes into account the tax rate for the applicable tax bracket.

To get the tax refund due, you subtract the total income tax from tax withheld for the year. If the tax withheld is greater than the total income tax, the difference would be the tax refund due to you. Where the tax income is higher than the tax withheld, the difference would be the tax payable.

Tax Return Calculator Terminologies Defined

Total income

Total income refers to the total of all your gross income from all your income sources. Where you have more than one income stream such as a salary and interest or dividend income, you have to add all the incomes from all the sources.

Tax withheld

For most income sources, some tax is deducted at source. Withholding tax is the amount deducted and paid to the government at source. The deduction is credited to your income tax liability to reduce the amount of tax that you have to pay at the end of the year.

Tax payable

The tax payable is the amount of tax that a taxpayer needs to pay. It is based on your total income taking into account tax withheld. You get the tax payable by multiplying the taxable income by the tax rate that applies to your tax bracket.

What Other Factors Can Affect Your Tax Return?

Filing Status

Your filing status defines whether you are filing as head or household, single, married filing separately, or married filing jointly. Your filing status affects the amount of tax you will pay. Each category has a different income tax brackets as well as the reliefs available.

Tax credits

You can get tax credits on your final tax bill, which would reduce your tax liability. Tax credits apply to certain conditions such as when the taxpayer enrolls in a government insurance plan, when paying for post-secondary education, when installing energy-efficient equipment for domestic use, and in cases of childcare expenses.

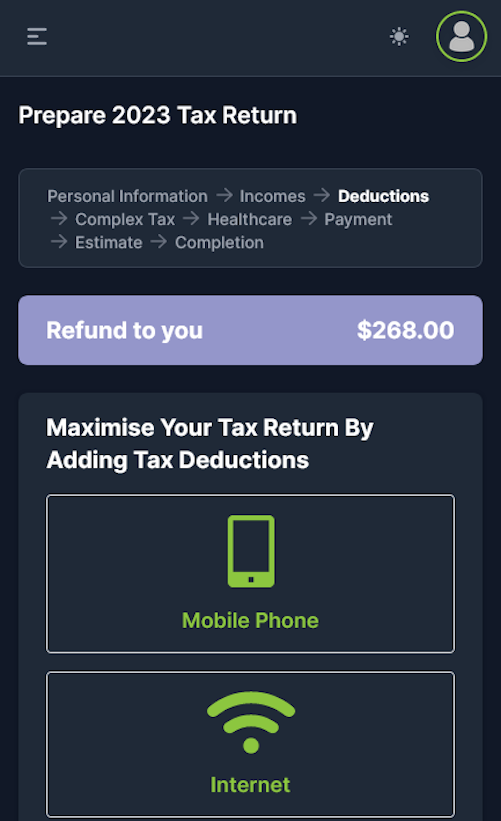

How to Make the Most Out of My Tax Return?

There are several strategies that you can use to make the most out of your tax return. Some of the strategies include claiming your work-from-home expenses, claiming other work-related expenses, making charitable donations, and getting refunds from your side hustle.

Claiming tax deductions is the most effective way of maximizing on tax returns. You should be able to claim all work-related expenses to reduce your tax liability. That includes your work-from-home expenses that relate to your taxable income.

Any charitable donation that is over $2 in value is deductible. Therefore, whenever you make a donation, you can deduct it from your income to reduce your tax liability. However, the donation must meet the certain conditions, as not all donations and gifts are tax deductible.

Although you should claim all the expenses you can, not all expenses are claimable. You need to check with the list of claimable expenses while working on your return.